Murray & Roberts Cementation’s second contract, for the trackless high speed development at Lubambe Copper Mine in Zambia, has been extended by a further two-year period.

The Lubambe Copper Mine which is a joint venture between African Rainbow Minerals, VALE and Zambia Consolidated Copper Mines Investment Holdings, is expected to produce 45 000 tonnes of contained copper at steady state by 2015.

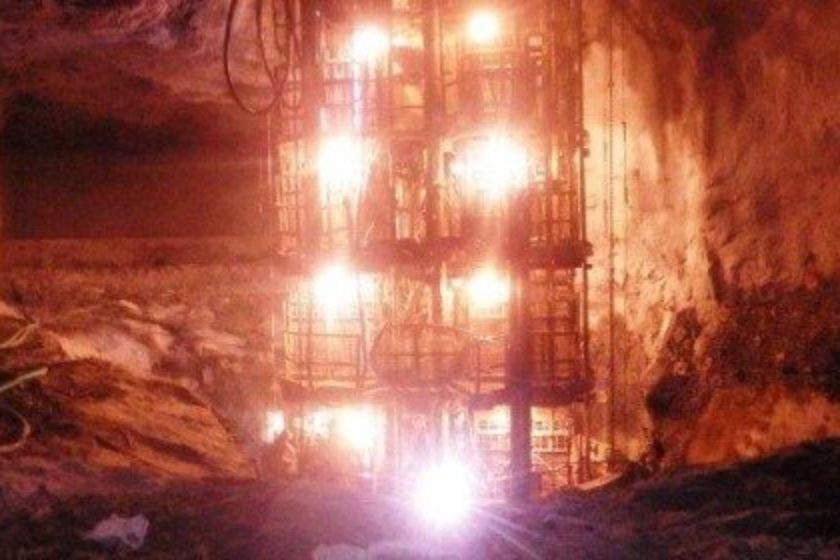

The current contract involves all horizontal development work using trackless high speed technology in Ramps 1, 2, 3, 4 and 5.

In addition, the Murray & Roberts Cementation team was also requested to undertake the vertical development of return airways, service raises and silos and maintenance work on the surface infrastructure, provided by Murray & Roberts Cementation on the first phase of the contract, will continue for the duration of the entire contract.

Murray & Roberts Cementation Senior Project Manager at Lubambe Wyllie Pearson, added that they will continue with several projects that were started under the first contract.

“We will continue the development of infrastructure for two conveyor belt systems and supply and install all temporary compressors and air piping reticulation necessary for the development works and diamond drilling section. Furthermore, we will install all temporary ventilation fans and ducting,” he said.

“We also operate and maintain the owner’s equipment fleet. Six Sandvik TH 540 dump trucks, four Sandvik LH 410 and one Sandvik LH 514 LHD, as well as nine Sandvik TH540 40-ton articulated dump trucks allocated to load and haul. Face charging is performed with three Getman emulsion charging units and the transport and lifting equipment consists of two Getman scissor lifts, a Fermel scissor lift and two Getman cassette handlers. A Fermel grader and Manitou 742 telehandler complete this fleet,” added Pearson.

Allocated to drilling are five Sandvik DS320 double boom split-feed jumbos, a DS320 fixed rail jumbo and a DS 420 long hole rig used for raise mining. The support and supervision vehicles are Toyota Land Cruisers, which have been converted to mining specifications.

“All maintenance work on this equipment as well as the Murray & Roberts Cementation equipment fleet is undertaken in our well-equipped on-site workshop by a highly experienced team of mechanics and technicians, to ensure optimised operability and uptime. All consumables are supplied by the mine,” he revealed.

Pearson said that the contract is characterised by a high level of cooperation between the Murray & Roberts Cementation and Lubambe Copper Mine teams.

“We have developed a mutually beneficial relationship that sees us providing our client with a ready and continuous supply of power and water handling facilities, to ensure efficient interaction within overlapping areas. In addition, the mine provides our team with rock bolts, split sets, mesh and cement, while diesel and lubrication oils are supplied as free-issue items.”

Since the extension of the first contract by 15 months, a total of 24 653 metres has been developed against a target of 23 458 m.

“We have made excellent progress to date and met every one of our scheduled targets. The two main underground tipping arrangements consisting of four tipping points and two silos were completed and commissioned within the scheduled construction dates. A mineral sizer was installed and commissioned ahead of schedule on the tips,” Pearson said.

The six level crusher chamber was rehabilitated and supported with welded mesh and 6 m cable anchors, with the crusher and equipment in place. In order to assist with the main return air system, a series of ventilation raises were developed from the ramp 3 225 Level and two 225 kW surface fans installed and commissioned.

The project has not been without its challenges. Some parts of the Lubambe ore-body can only be accessed by mining through a very weak zone of sand-like material. The sand zone developing and support project comprises four successfully completed sections with a fifth in progress.

These sand zones require specialised support methods developed specifically for Lubambe and are similar to civil tunnelling support methods. Pearson explains that this has been effectively achieved by using Titan soil nails, Becker Arch Sets, 5,6 mm welded mesh and shotcrete as support mediums. Sand is excavated out of the face using a Hyundai 35Z7 mini excavator.

At the request of the client, a drop raising programme was undertaken, with 12 345 metres completed concurrently with contractual development.

Pearson expressed belief that the success of the project to date can be attributed to a number of factors, including the creation of a highly efficient team of experienced and multinational operators, supervisors and management, mostly with previous expatriate experience. The drilling team is a mixture of Australian decline mining specialists and Filipino and South African expats.

The team comprises 405 employees, with approximately 12% expatriates. The Zambian national component of the team is made up of HR staff, surveyors, accounts and administration staff, skilled operators, officials and workmen. The expat component of the crew consists of site management, safety and training staff and expert miners, operators and maintenance staff.

Similarly, training plays a big role in ensuring that the requisite regulations and quality standards are achieved and maintained.

“The training at Murray & Roberts Cementation’s Bentley Park facilities included trackless mining modules. The nature of the ore bodies in Zambia is such that most of the mining is fully trackless, with the exception of the haulage levels. There is a vast pool of fully trained and experienced mine workers available to recruit from, which has greatly simplified the human capital element of the project,” Pearson pointed out.

He said there was a successful transformation from a small highly skilled decline sinking crew, to a team responsible for ore and main development, sometimes in remote and scattered areas of the mine.

Employees also have access to a modern e-learning centre which has been opened at Murray & Roberts Cementation’s Synclinorium shaft sinking project in Kitwe

“This centre provides the same high quality standards as the Bentley Park facility in South Africa. The comprehensive Murray & Roberts electronic library and learning system is available for learners and facilitators alike,” quipped Pearson.

Appropriate and successful training is reflected in the safety record achieved on site, with no Lost Time Injuries (LTI) recorded for the first year. There have also been no fatal incidents on the contract to date, a noteworthy achievement given the nature of the project.

The award of the Synclinorium shaft sinking project, as well as the shaft sinking and development of the Mufulira Deeps project are a true reflection of the company’s reputation in the region.

In addition, Murray & Roberts Cementation’s Raise Boring Division is presently operating in Kansanshi, a further indication of the significant growth in the company’s presence in Zambia.

“Murray & Roberts Cementation has demonstrated complete commitment to its Zambian projects through the formation of a Zambian division with corporate offices situated in Kitwe. We are presently able to offer prospective clients a full shaft sinking and development portfolio, including training and administration from Zambia, with the benefit of technical and logistical support from Murray & Roberts Cementation in South Africa,” Pearson said.

Source: Mining News Zambia