Konkola Copper Mines Plc remains under the management of the Provisional Liquidator, according to an official statement from the mining company.

“Konkola Copper Mines Plc (“KCM”) remains under the management and control of the provisional liquidator, pursuant to the Court Order dated 21st May 2019”, read a statement issued by General Manager Corporate Affairs Shapi Shachinda on 10th December 2021. “We note a Vedanta Resources Holdings (“Vedanta”) statement dated 7th December 2021 which seeks to give the impression that they have regained management control of the KCM asset”.

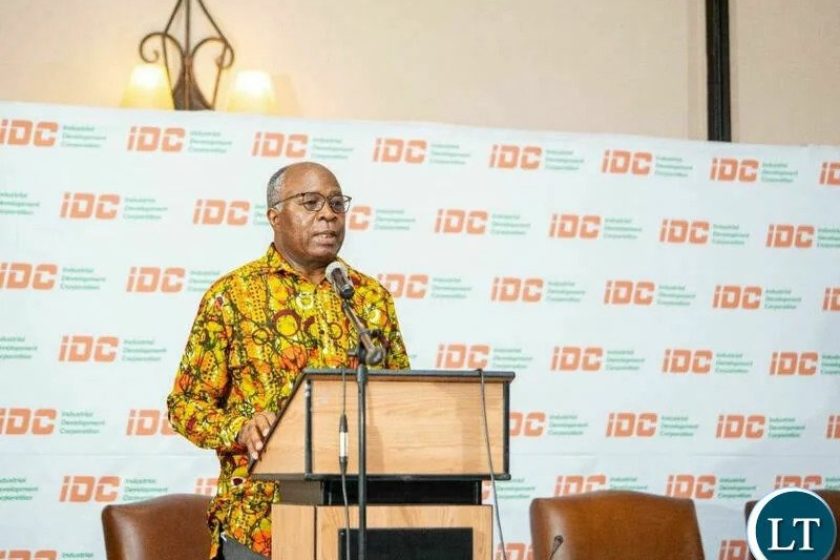

According to a media release attributed to Vedanta, Dr Moses Banda was announced as the Spokesperson of Vedanta in Zambia. “Vedanta Resources Holdings Limited and its parent, Vedanta Resources Limited is pleased to announce that Dr Moses Banda, Vedanta’s Country Director as the official spokesperson in Zambia”.

“Dr Banda is a prominent voice Vedanta is extremely pleased to have Dr Banda’s experince on board to focus on rebuilding KCM, protecting 12,000 jobs in KCM and looks forward to engaging with the Zambian communities”, further read the statement.

However, “Members of the public are advised to disregard this deliberate attempt to mislead the nation”, in a rebuttal to the aforementioned statement by Shachinda. “Vedanta remains uninvolved in the running of operations at KCM”.

Sensing that the Vedanta statement may cause concern amongst key stakeholders, Shachinda further stated that “they appealed to all KCM employees, labour unions representing KCM employees, KCM Creditors, Contractors and Suppliers as well as the Company’s business partners and other key stakeholders to remain calm”.

Further Cautionary Announcement from ZCCM IH as at 28th July 2021

The following is an extract of the SENS announcement published in July this year regarding the matter from ZCCM IH’s Company Secretary Chabby Chabala on behalf of the Board of ZCCM IH regarding the Arbitration matter.

Shareholders of ZCCM Investments Holdings Plc (“ZCCM-IH”) are referred to the announcement dated 23 May 2019 concerning the following:

- ZCCM-IH filing a petition in the High Court of Zambia for the winding up of Konkola Copper Mines PLC (“KCM”) on 21 May 2019 (the “Petition”) and the appointment by the Court of Mr Milingo Lungu as provisional liquidator of KCM (the “Provisional Liquidator”);

- The legal proceedings commenced by Vedanta Resources Limited and Vedanta Resources Holdings Limited (together “Vedanta”) against ZCCM-IH on 2 July 2019 in the High Court of South Africa;

- Vedanta’s applications to the High Court of Zambia to stay the liquidation proceedings and refer the matter to arbitration.

The South African proceedings were pursuant to the Arbitration proceedings which were yet to be commenced and were eventually commenced by Vedanta against ZCCM-IH on 31 July 2019. The Arbitration proceedings (which are confidential as between the parties) are underway and yet to be finally resolved. Shareholders, are however, advised that on 7 July 2021 the Sole Arbitrator made a Partial Final Award (“the Award”). The Award was in some parts in favour of ZCCM-IH and in some parts in favour of Vedanta. The Award has no effect on ZCCM-IH’s application for leave to appeal against the decision of the Court of Appeal announced in ZCCM-IH’s further cautionary announcement of 23 June 2021. Further, the Award has no effect on the position of the Provisional Liquidator, who remains in office.

ZCCM-IH will provide details on this matter in due course.

In the meantime, Shareholders of ZCCM-IH are advised to exercise caution when dealing in securities of the Company until further information is published.

By Order of the Board

Chabby Chabala

Company Secretary

Issued in Lusaka, Zambia on 28 July 2021

Source: https://fizambia.com/vedanta-still-not-in-charge-of-kcm-asset-shachinda-sets-record-straight/